Home prices are starting to dip in some markets. If you’re reconsidering your plans based on what you’re hearing in the media, here’s what you need to know.

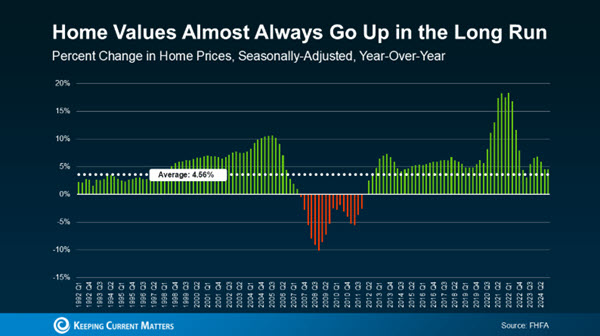

Although a few metros are seeing slight price drops, it’s important to note that home values generally increase over time (see graph below).

The housing crash of 2008 was an anomaly and not the norm. It was caused by various factors such as relaxed lending standards, lack of homeowner equity, and oversupply of homes, differing significantly from the current national housing market. Therefore, every headline about slowing down, normalizing, or dipping prices doesn’t necessarily imply another crash is imminent.

Short-term dips usually aren't significant over the long term.

What’s the Five-Year Rule?

In real estate, the five-year rule suggests that if you plan to own your home for at least five years, short-term dips in prices generally don’t impact you much. Home values tend to increase over the long term, even if there are slight declines for a year or two.

Lance Lambert, Co-Founder of ResiClub, explains:

“. . . there’s the ‘five-year rule of thumb’ in real estate—which suggests that most buyers can buffer themselves from mild short-term declines if they plan to own a property for at least that amount of time.”

What’s Happening in Today’s Market?

Currently, most housing markets are still seeing home prices rise, though not as fast as in previous years.

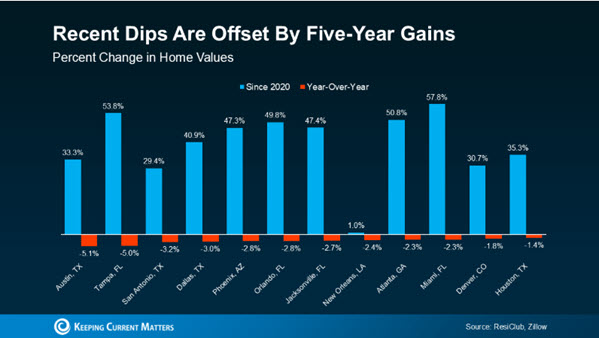

In the major metros, where prices are beginning to cool off (the red bars in the graph below), the average drop since April 2024 is only about -2.9%, which is not a significant decline compared to the 2008 crash.

The graph below shows that prices in most of these markets are substantially higher than five years ago (the blue bars), indicating that homeowners who have held onto their properties for a few years are still ahead (see graph below).

The Big Picture

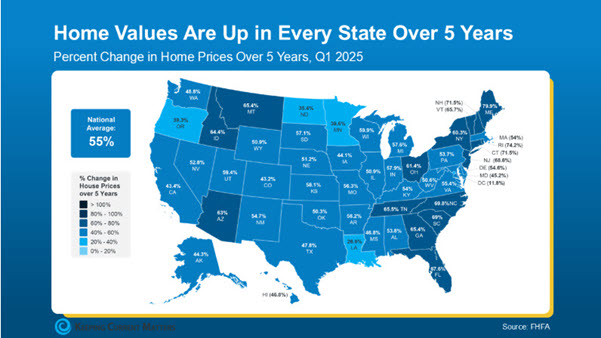

Over the past five years, home prices have risen by approximately 55%, according to the Federal Housing Finance Agency (FHFA). A small short-term dip does not represent a significant loss. Even in cities where prices have dropped by around 2%, the overall growth remains considerably higher.

Data from the FHFA shows that home values have increased in every state over the last five years (see map below).

Bottom Line

While prices can change in the short term, history indicates that home values generally increase over five years. Whether buying or selling, consider the five-year rule and focus on the long-term perspective.