You’ve probably seen the headlines predicting a housing crash. Scroll long enough and you’ll see everything from “market collapse” to “price freefall.” But here’s the thing: those dramatic claims are far from the full story. Let’s unpack what’s actually happening with home values—and where they’re headed in the years ahead.

Spoiler: It’s not a crash. Not even close.

What’s Going On Right Now?

In some markets, home prices are leveling off or even dipping slightly. That’s mostly due to a rise in inventory—more homes for sale means more choices for buyers, which takes pressure off prices. But that’s a normal market shift, not a red flag.

Zoom out, and the national picture looks much calmer—and more encouraging—than the headlines suggest.

What the Experts Are Predicting

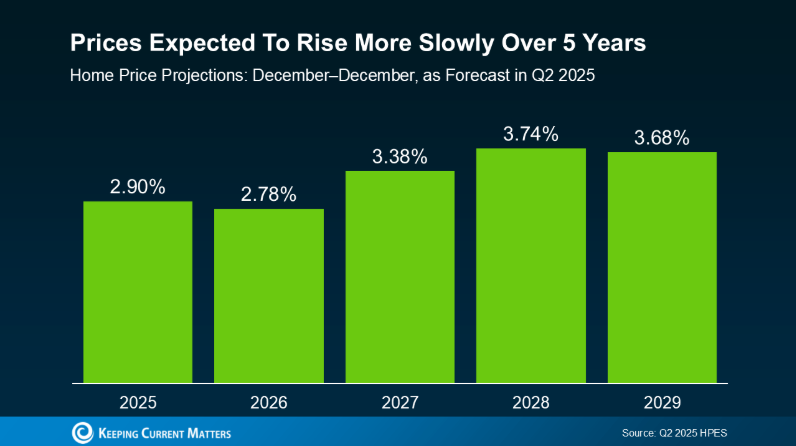

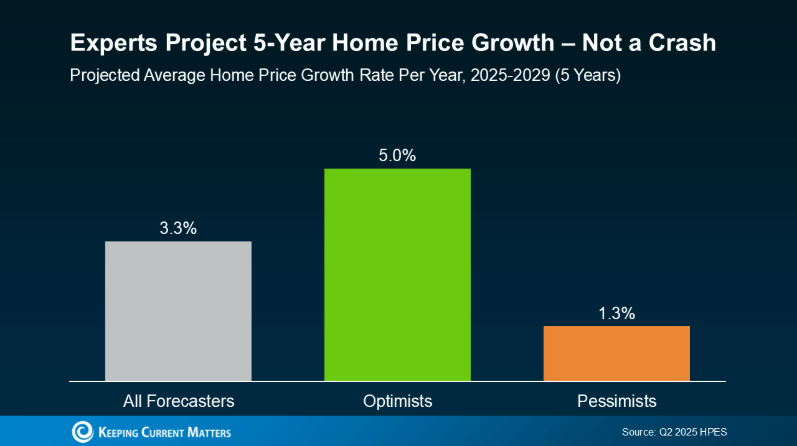

Fannie Mae recently released their Home Price Expectations Survey, gathering insights from over 100 top housing economists, analysts, and market strategists. The consensus? Prices are expected to continue rising over the next five years—just not as aggressively as we’ve seen in recent years.

Here’s how their projections break down:

- 📈 Average forecast: ~3.3% annual appreciation through 2029

- 🟢 Most optimistic projections: Around 5.0% annual growth

- 🔵 More cautious outlooks: Even the most conservative experts see ~1.3% annual growth

The big takeaway? None of the experts are predicting a national drop in home prices. Not one. The overall trend points to steady, sustainable growth—exactly what a healthy market needs.

Why This Is Actually Good News

Runaway price growth might sound exciting, but it’s not great for buyers—or long-term stability. A slower pace of appreciation means more affordability, fewer bidding wars, and a chance for the market to recalibrate.

Yes, some local markets will cool more than others. In areas where supply is growing faster than demand, prices might hold steady or dip slightly. On the flip side, regions still facing tight inventory could continue to see strong price gains.

But across the board, the fundamentals are solid:

- 📉 Low foreclosure rates

- 💳 Responsible lending practices

- 💰 High homeowner equity

Those three factors create a strong foundation—one that makes a dramatic crash highly unlikely.

Thinking of Waiting for a Crash? You Might Be Waiting a While

Let’s be real: if you’re hoping for a big drop in prices before buying, you may be sitting on the sidelines longer than you planned. While no one can predict the future with 100% certainty, the most reliable voices in housing are all saying the same thing—moderate growth is here to stay.

Bottom Line: Think Local, Not Just National

If you’ve been feeling stuck—unsure whether to move, buy, or sell—it might be time to shift your perspective. The market isn’t collapsing. It’s adjusting. And that can be a great opportunity, especially if you understand what’s happening in your neighborhood.

National numbers set the tone, but real estate is always local. So before making a decision based on headlines, let’s talk about what’s really happening in your zip code.

📞 Ready for a quick, data-driven conversation? I’d love to show you how the numbers apply to your unique situation.