You may have heard that the number of homes for sale has recently reached a peak. This could lead you to wonder if it signals the beginning of another housing market crash.

However, the data indicates that this is not the case. In most regions, an increase in inventory is not necessarily negative news; rather, it suggests that the market is moving toward a more stable and healthy state.

Current Inventory Status

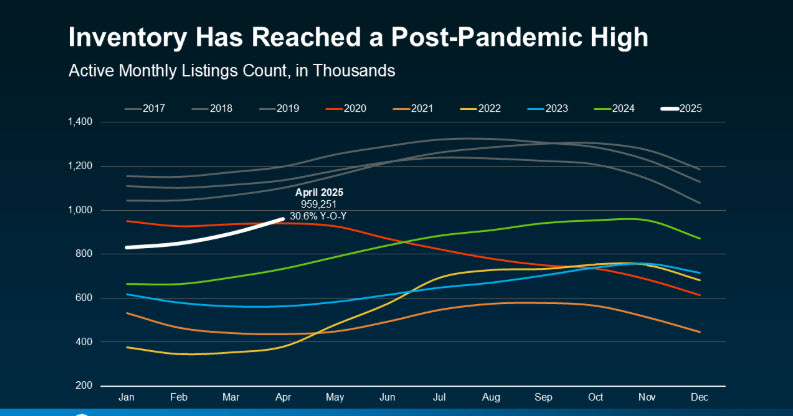

According to recent data from Realtor.com, inventory has reached its highest point since 2020, as illustrated by the white line in the graph below. It is important to note that despite this rise, inventory levels have still not returned to pre-pandemic norms.

This means there are now more homes available for sale than we’ve seen in quite some time.

While it’s true that inventory has risen significantly compared to the low levels of recent years, the overall number of homes on the market remains well below typical historical levels. This is an important detail to keep in mind.

Why Rising Inventory Isn’t as Concerning as It May Seem

When some people hear that inventory is increasing, they immediately draw comparisons to 2008, when a surge in available homes preceded the housing market crash. However, the current situation is entirely different.

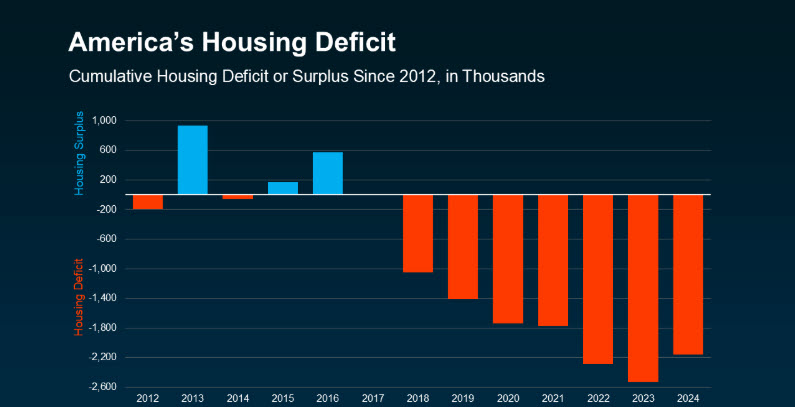

The key difference lies in the fact that we don’t have an oversupply of homes. Instead, we’re dealing with a significant housing deficit that’s been building for years. This is a long-term issue, and it’s substantial.

The red bars in the graph below highlight the years since 2012 when new housing construction fell short of keeping pace with household formation. The deeper the bars, the greater the housing shortfall. Although inventory has recently grown, this uptick only begins to address the severe gap that has developed over more than a decade. Understanding this context is crucial to recognizing why today’s housing market is not facing the same risks as in the past.

One of the reasons for the ongoing housing shortage is that new home construction has not kept pace with the number of people needing homes. Currently, there is a substantial deficit of homes in the U.S., amounting to millions, and addressing this gap will take years. Realtor.com states:

“At a 2024 rate of construction relative to household formations and pent-up demand, **it would take 7.5 years to close the housing gap.”

This indicates that, in most areas, there is no immediate risk of an oversupply of houses. On the contrary, many markets require more homes. Therefore, although inventory is increasing, it is not problematic on a national scale. Instead, it is beginning to address a long-standing housing deficit.

Bottom Line

Rising inventory should not be alarming. It suggests progress towards a more balanced and stable housing market.

Housing inventory trends, U.S. housing shortage, Real estate market stability, New home construction deficit

Source: Real Estate with Keeping Current Matters