If you’ve been holding off on buying a home because of high mortgage rates, now might be the perfect time to take another look at the market. Mortgage rates have been trending downward recently, creating an opportunity for buyers to step back in.

A Surprising Decline in Mortgage Rates

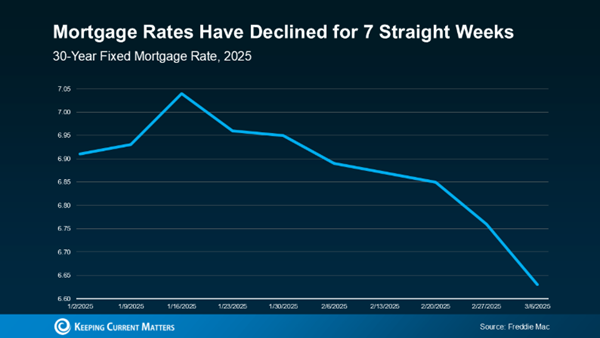

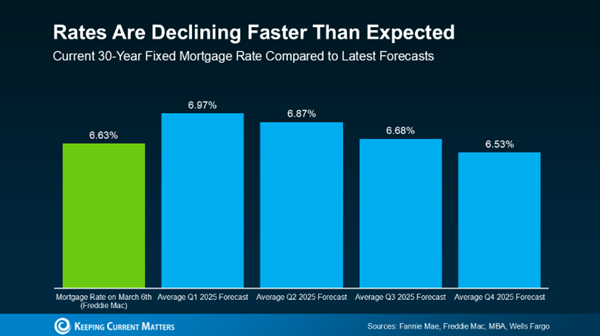

According to Freddie Mac, mortgage rates have been declining for seven straight weeks, with the average weekly rate hitting its lowest level so far this year. While the shift may seem modest, the drop from over 7% to the mid-6% range is significant. What makes this even more surprising is that most forecasts predicted we wouldn’t see these levels until the third quarter of the year.

Why Are Mortgage Rates Dropping?

Economic uncertainty is playing a major role in pushing rates lower. According to Joel Kan, VP and Deputy Chief Economist at the Mortgage Bankers Association (MBA):

“Mortgage rates declined last week on souring consumer sentiment regarding the economy and increasing uncertainty over the impact of new tariffs levied on imported goods into the U.S. Those factors resulted in the largest weekly decline in the 30-year fixed rate since November 2024.”

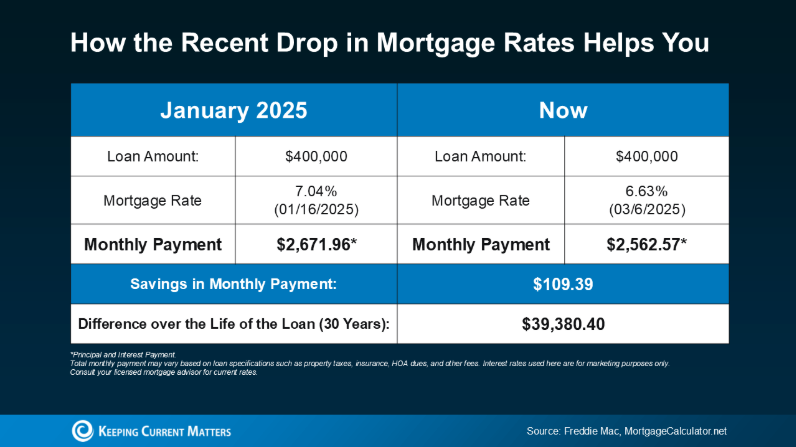

This decline has created a unique opportunity for homebuyers. In just a few weeks, the anticipated payment on a $400K loan has dropped by over $100 per month—a significant savings that can make homeownership more affordable.

What Lower Rates Mean for Your Buying Power

Even small shifts in mortgage rates can impact your purchasing power. For example, if you were considering buying a home when rates were at their peak (7.04% in mid-January), your monthly mortgage payment would have been noticeably higher compared to what it would be today with lower rates.

This is especially important as we enter the spring market, a time when housing inventory typically rises and more buyers start actively searching. The current dip in rates could be the break you’ve been waiting for to make your move.

Should You Wait or Act Now?

While rates have come down, they remain volatile and can change quickly based on economic factors. If you’ve been waiting for rates to drop further, consider that this window of opportunity might not last long. Timing the market perfectly is nearly impossible, and waiting too long could mean missing out on today’s more favorable conditions.

Bottom Line

Mortgage rates have dipped, offering buyers a chance to secure a lower monthly payment and increase their affordability. If you’ve been on the fence about buying a home, now may be the time to make a move before rates fluctuate again.

Would a lower monthly payment make homeownership feel more within reach for you? If so, this could be your moment to jump in and take advantage of the current market conditions.